My goal is to develop a buy now pay later feature to address the cash flow problem by offering a solution that allows clients to strategically allocate their budgets and invest in growth initiatives without the burden of immediate payment, providing them with enhanced financial flexibility. My design focuses on making the "pay now, buy later" feature not just a tool but a user-centric solution enhancing financial flexibility for digitally native businesses.

One potential challenge for us in implementing such feature is managing the associated financial risks. Allowing clients to delay payments introduces a level of uncertainty in terms of cash flow for the company. Balancing the need to offer flexible terms with the necessity of maintaining financial stability and minimizing default risks is a delicate challenge. Effective risk assessment, stringent credit checks, and clear communication of terms will be essential to mitigate this challenge and ensure the feature benefits both the clients and our financial health Additionally, striking the right balance between flexibility and responsible lending practices will be crucial to the success of the feature.

The primary challenge in developing a "buy now, pay later" (BNPL) feature for the Dash.fi platform lies in effectively mitigating the immediate financial strain faced by businesses with significant marketing budgets. The core issue revolves around addressing the cash flow constraints encountered by digitally native businesses, particularly in the realm of managing advertising expenses. Crafting a solution that enables clients to strategically allocate their budgets and invest in growth initiatives while alleviating the burden of immediate payment is complex. This endeavor requires careful consideration of risk management, seamless integration into the existing platform, and a user experience design that not only serves as a financial tool but genuinely enhances flexibility for businesses navigating the challenges of digital commerce. Balancing these aspects while staying attuned to compliance, user education, and robust default management will be pivotal in creating a BNPL feature that truly addresses the financial needs of digitally native businesses on the Dash.fi platform.

To ensure the effectiveness of this feature, I am deeply engaged in understanding the financial needs and behaviors of our target users. Through extensive user interviews and feedback sessions, I uncovered the unique pain points and challenges these businesses face in managing cash flow associated with advertising expenses. Concurrently, a thorough competitor analysis allows me to identify industry best practices, differentiators, and potential areas of improvement. Complementing this, a comprehensive examination of user feedback, gathered through surveys and interviews, provides invaluable insights into expectations and concerns. Simultaneously, a detailed exploration of the legal landscape surrounding flexible payment terms ensures compliance with regulations and laws, safeguarding both our users and our platform. By synthesizing these research components, I strive to design a feature that not only addresses user needs but also sets a new standard in the financial technology landscape for digitally native businesses.

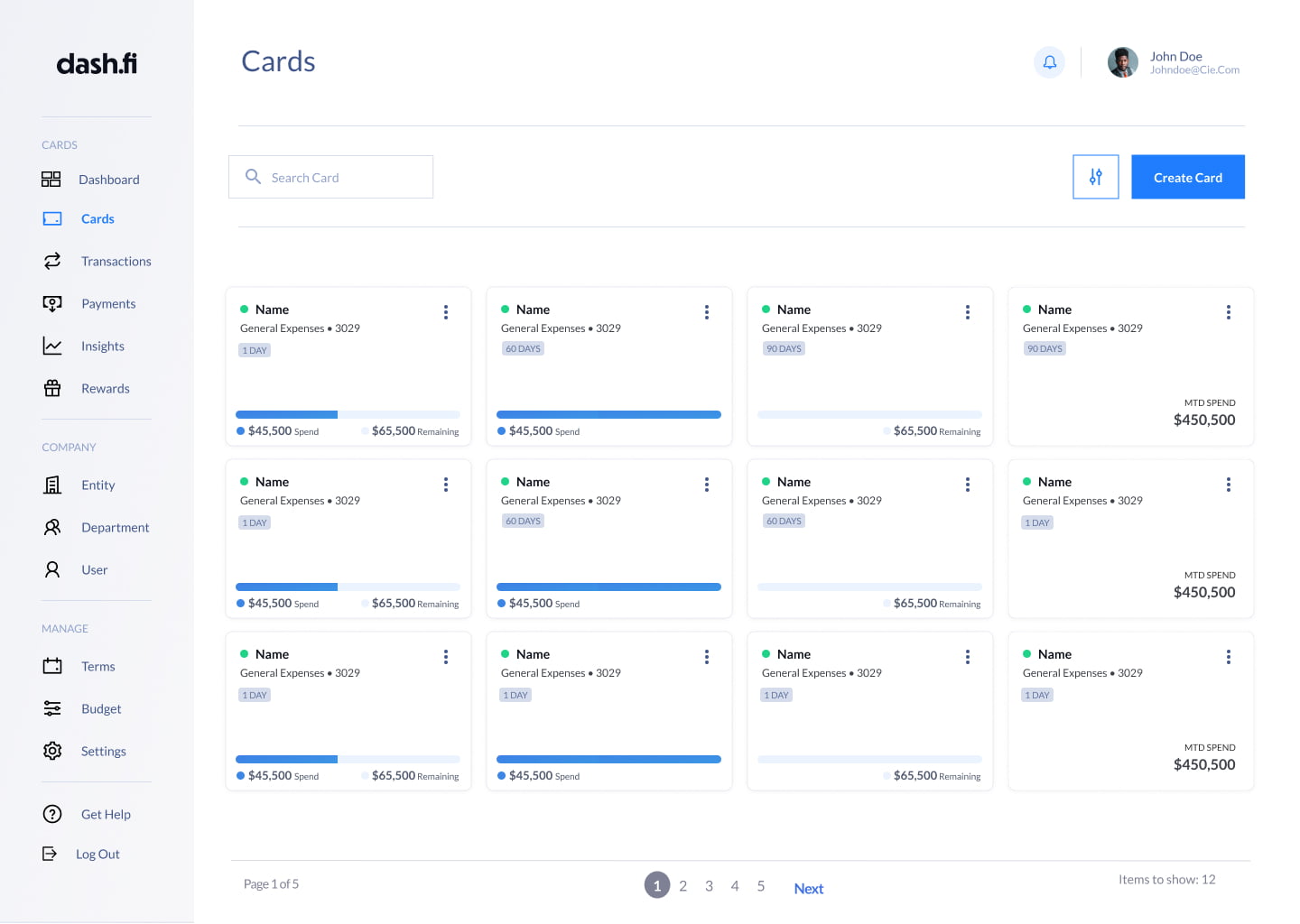

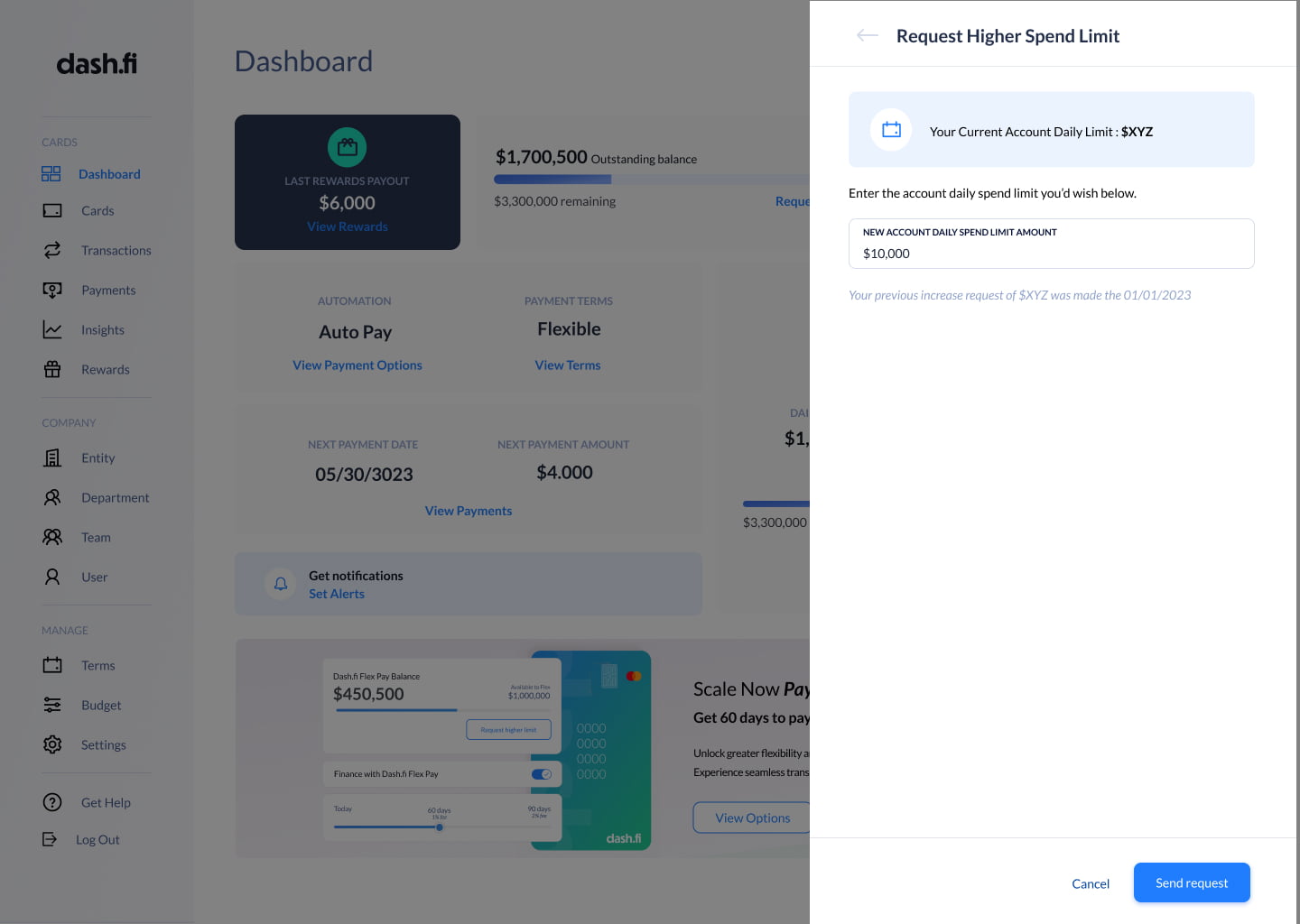

In a market where competitors either lack a flexible term payment feature or restrict users to fixed terms like 30, 60, or 90 days, I am taking a distinctive approach with Dash.fi. While initially considering a binary choice between two terms, I recognize the importance of understanding the diverse needs of our users. Through upcoming user interviews, I aim to gather valuable feedback that will guide the design of a flexible term payment feature, allowing us to offer options that truly align with the financial preferences and circumstances of our users. This user-centric strategy not only sets us apart in the market but ensures that our offering is finely tuned to meet the unique requirements of digitally native businesses with substantial marketing budgets.

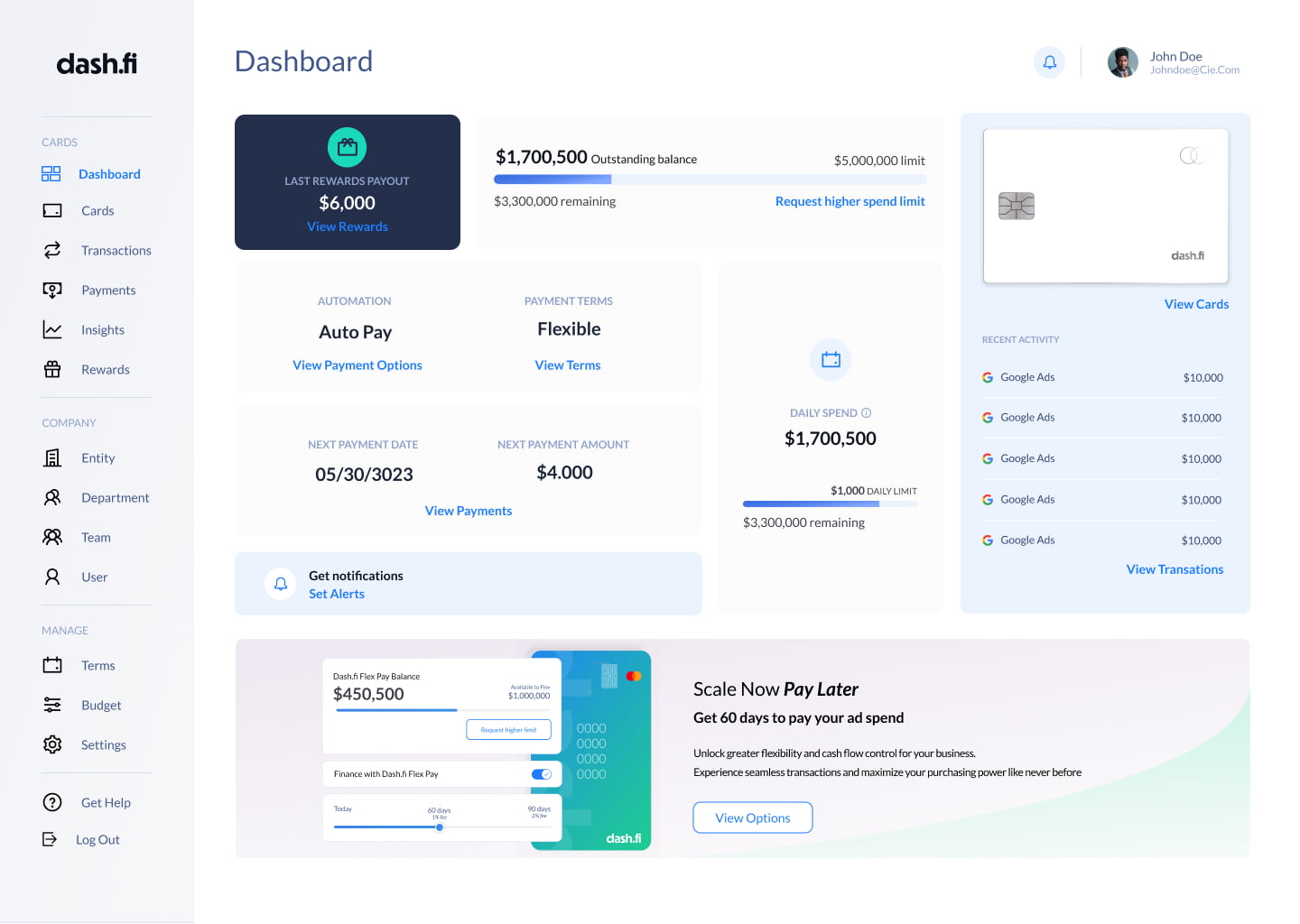

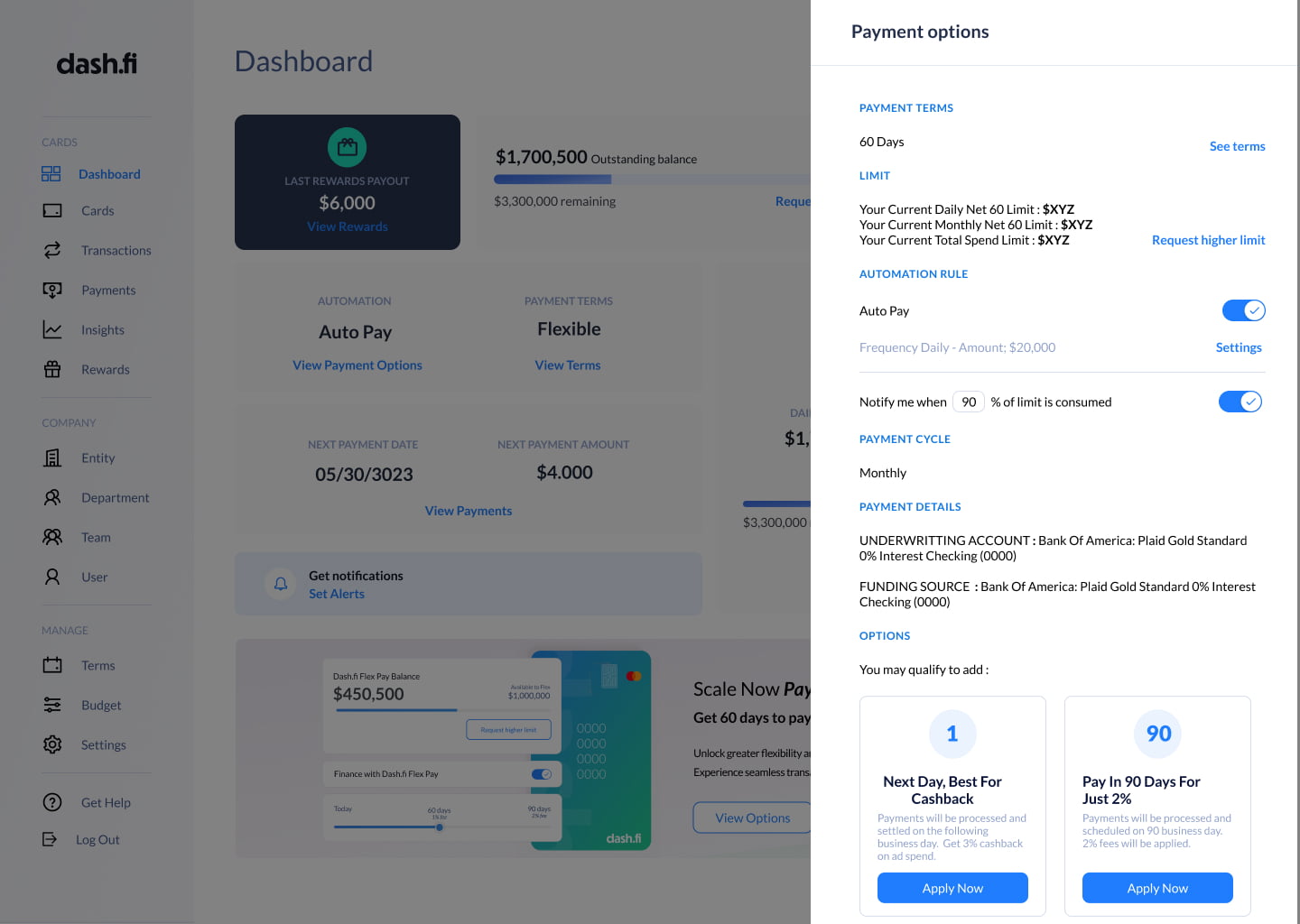

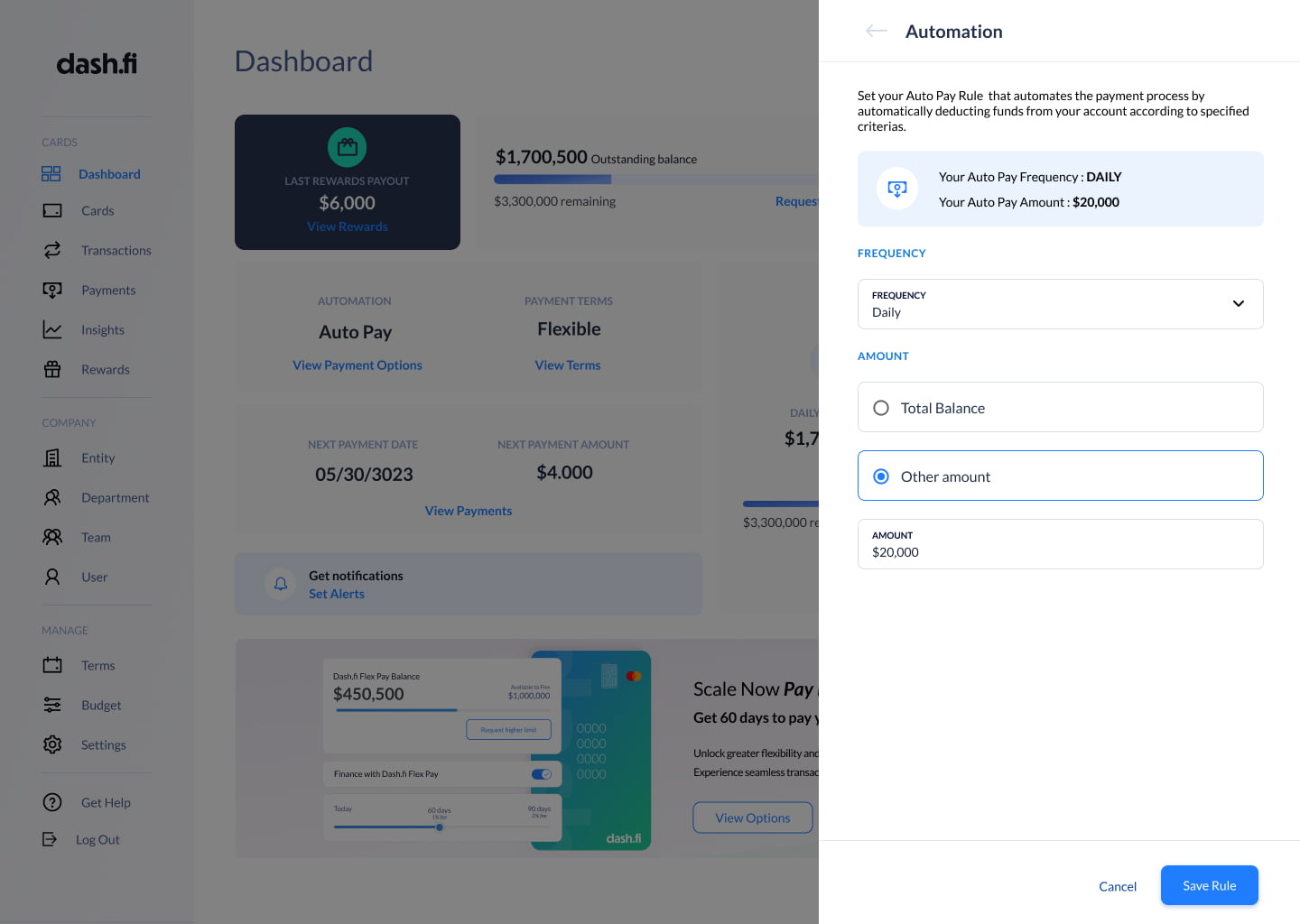

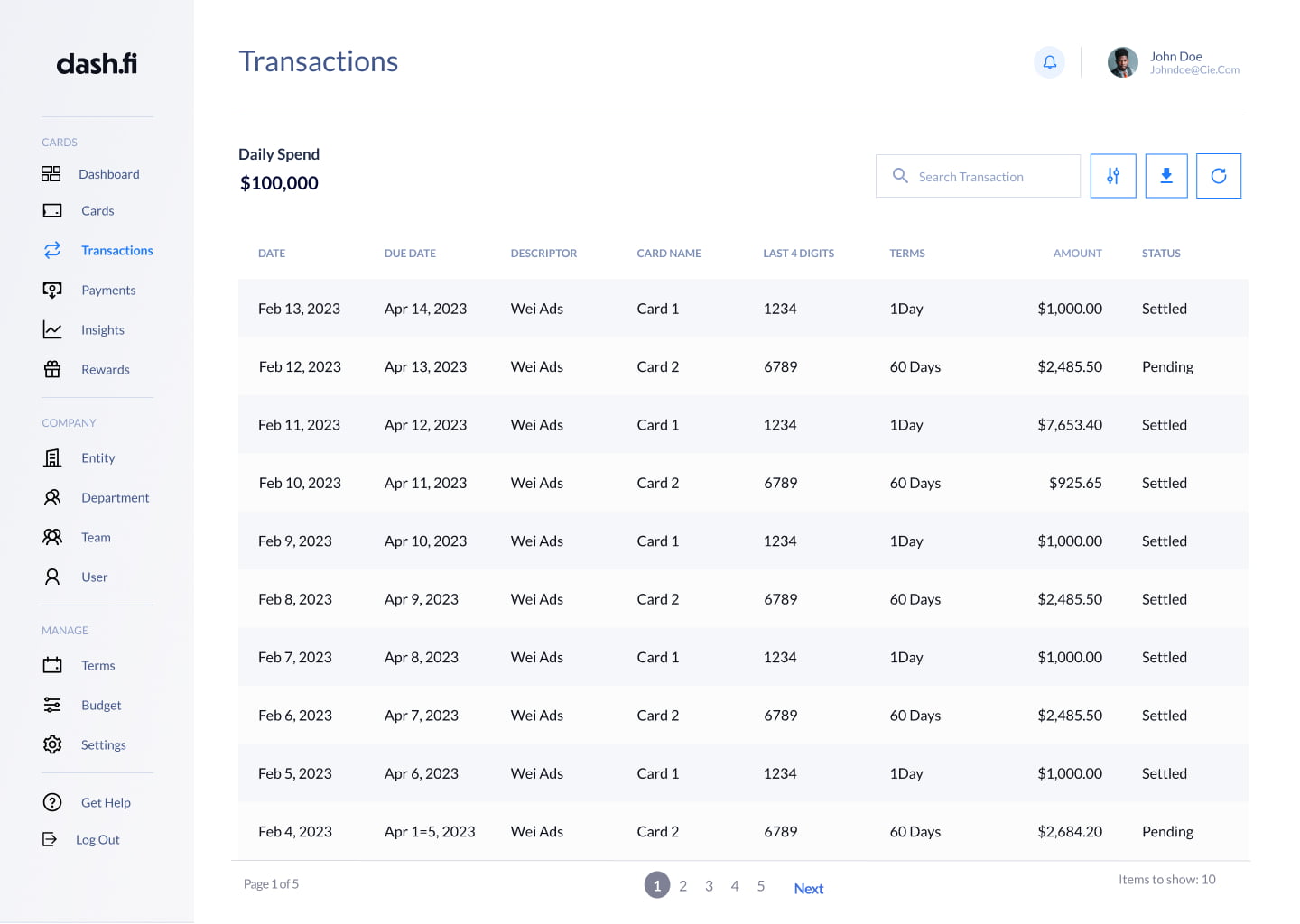

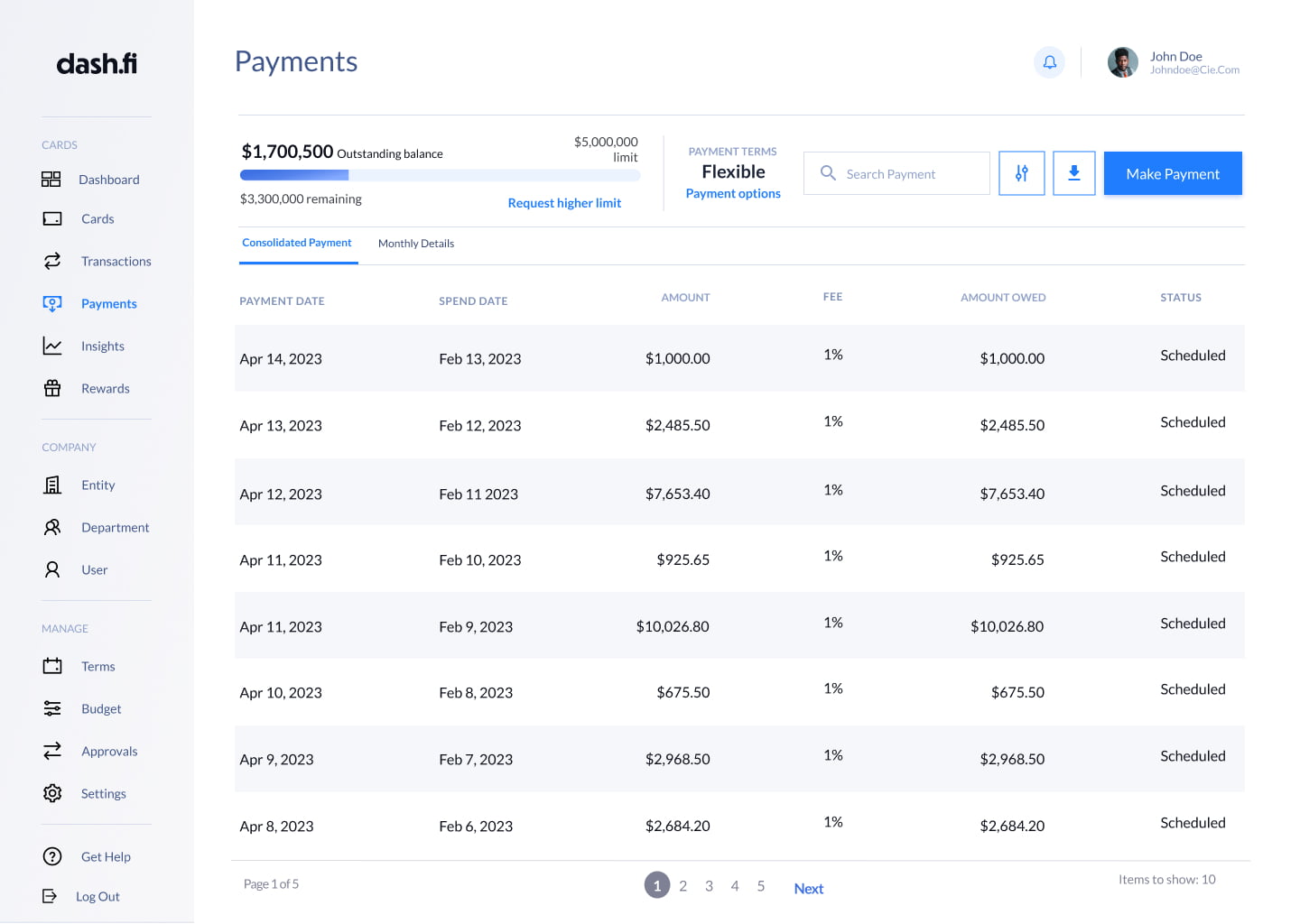

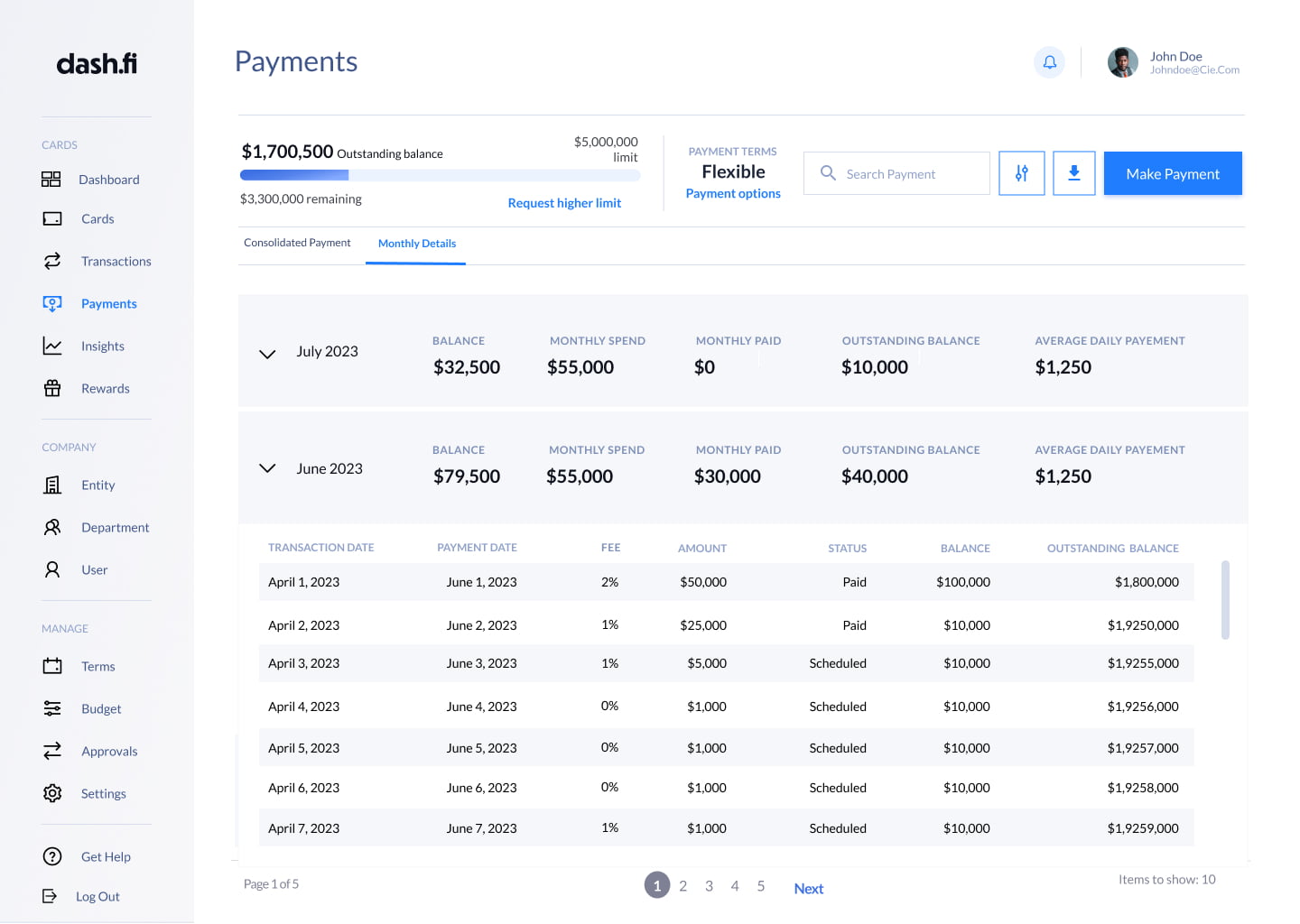

Considering the product design standpoint for developing this feature, the choice between offering various products with distinct payout terms and a more flexible payment option introduces a nuanced design challenge. Developing separate products tailored to specific payout durations may provide users with targeted solutions, offering a clear and straightforward experience for those who prefer specific timeframes such as next day, 30 days, 60 days, or 90 days. On the other hand, the concept of a flexible payment feature, while potentially more complex in its implementation, could cater to a broader audience with diverse financial needs. From a design perspective, the challenge lies in striking a balance between customization and simplicity. The UI should empower users to easily select and customize their preferred payment terms while maintaining a cohesive and intuitive overall experience. I will create a design that is both flexible and user-friendly, ensuring that whether users opt for specific product durations or a more adaptable payment schedule, the BNPL feature enhances financial flexibility seamlessly within the Dash.fi platform.

Users seek a flexible term payment feature to gain control over their finances and better manage their budgets. In businesses with fluctuating income streams, this feature becomes invaluable, bridging cash flow gaps without causing immediate strain. The ability to strategically invest in growth initiatives or marketing campaigns, without the burden of immediate payment, is a key advantage. Users appreciate the adaptability of flexible payment terms to their business cycles, aligning expenditures with revenue highs and lows. Additionally, the option to avoid interest accumulation during a specified period caters to those who prefer a convenient interest-free approach. The flexibility provided contributes to enhanced financial planning, allowing users to allocate resources efficiently and make informed decisions. Above all, users value a seamless and user-centric experience, characterized by clear terms, transparent communication, and easy navigation, ensuring that the flexible term payment feature truly aligns with their financial objectives and preferences.

The primary challenge in developing a "buy now, pay later" (BNPL) feature for the Dash.fi platform lies in effectively mitigating the immediate financial strain faced by businesses with significant marketing budgets. The core issue revolves around addressing the cash flow constraints encountered by digitally native businesses, particularly in the realm of managing advertising expenses. Crafting a solution that enables clients to strategically allocate their budgets and invest in growth initiatives while alleviating the burden of immediate payment is complex. This endeavor requires careful consideration of risk management, seamless integration into the existing platform, and a user experience design that not only serves as a financial tool but genuinely enhances flexibility for businesses navigating the challenges of digital commerce. Balancing these aspects while staying attuned to compliance, user education, and robust default management will be pivotal in creating a BNPL feature that truly addresses the financial needs of digitally native businesses on the Dash.fi platform.