My objective is to streamline the client onboarding process, making it seamless and efficient. I want to create an outstanding first impression for clients, increase the number of new applications, and reduce the time it takes to submit them. Simultaneously, I aim to enhance Know Your Customer (KYC) procedures and risk mitigation, leading to decreased churn rates. My overarching goal is to eliminate friction in the onboarding journey, ensuring a positive experience for clients and driving business growth.

In our startup, we face a set of critical business challenges that demand our focused attention. First and foremost, we are committed to making the onboarding process as seamless as possible for our users. Simultaneously, we must navigate the complex landscape of compliance and regulations while ensuring the utmost security and privacy to build trust with our customers. By effectively mitigating fraud and reducing churn rate, we aim to create a robust and dependable platform. Additionally, we recognize the importance of establishing trust right from the start and minimizing the time it takes for a user to create an account. A key objective is also to reduce support ticket volumes associated with onboarding, ultimately enhancing user satisfaction and acquiring new users swiftly. These challenges define our path forward, guiding our efforts to provide a superior user experience.

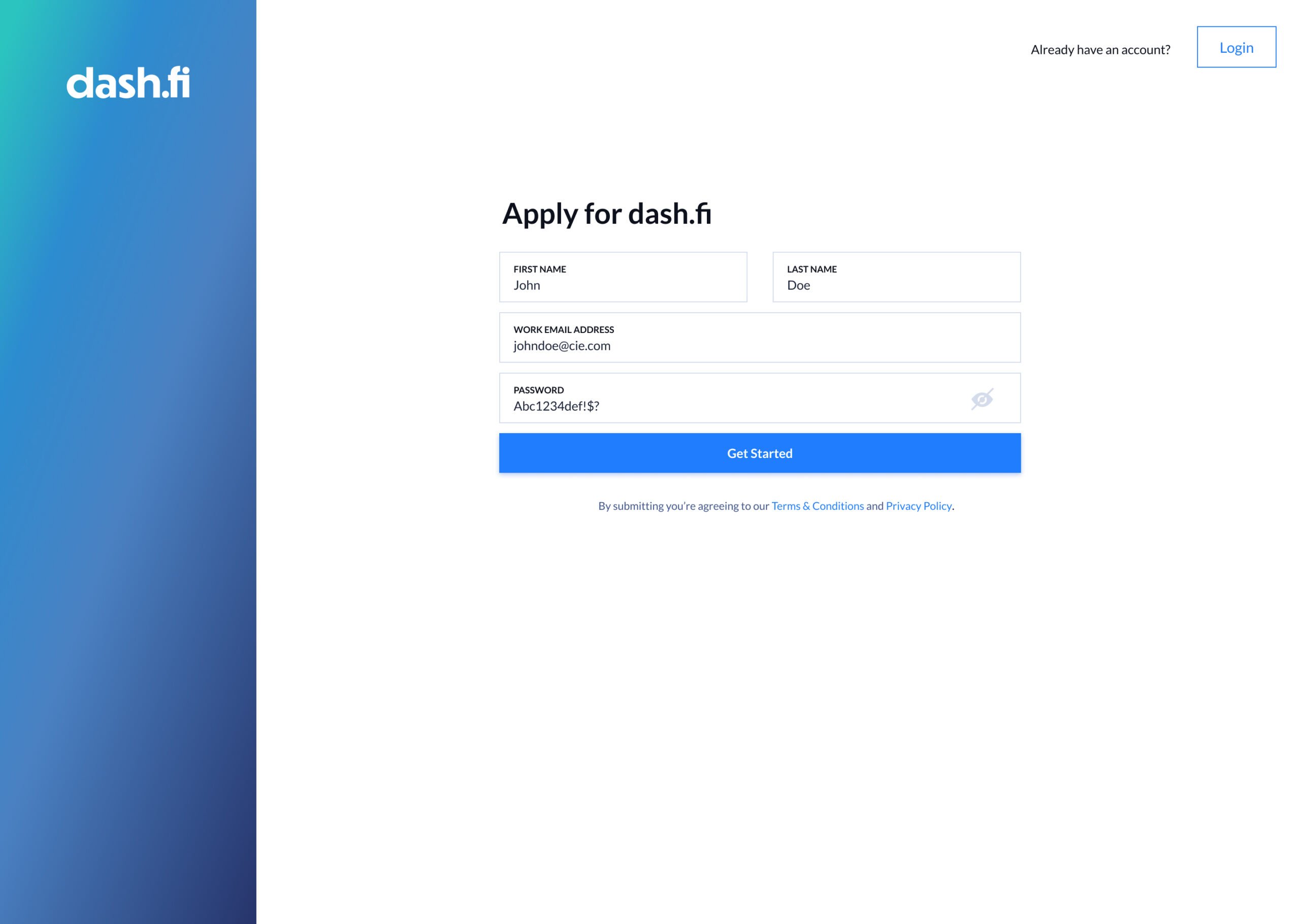

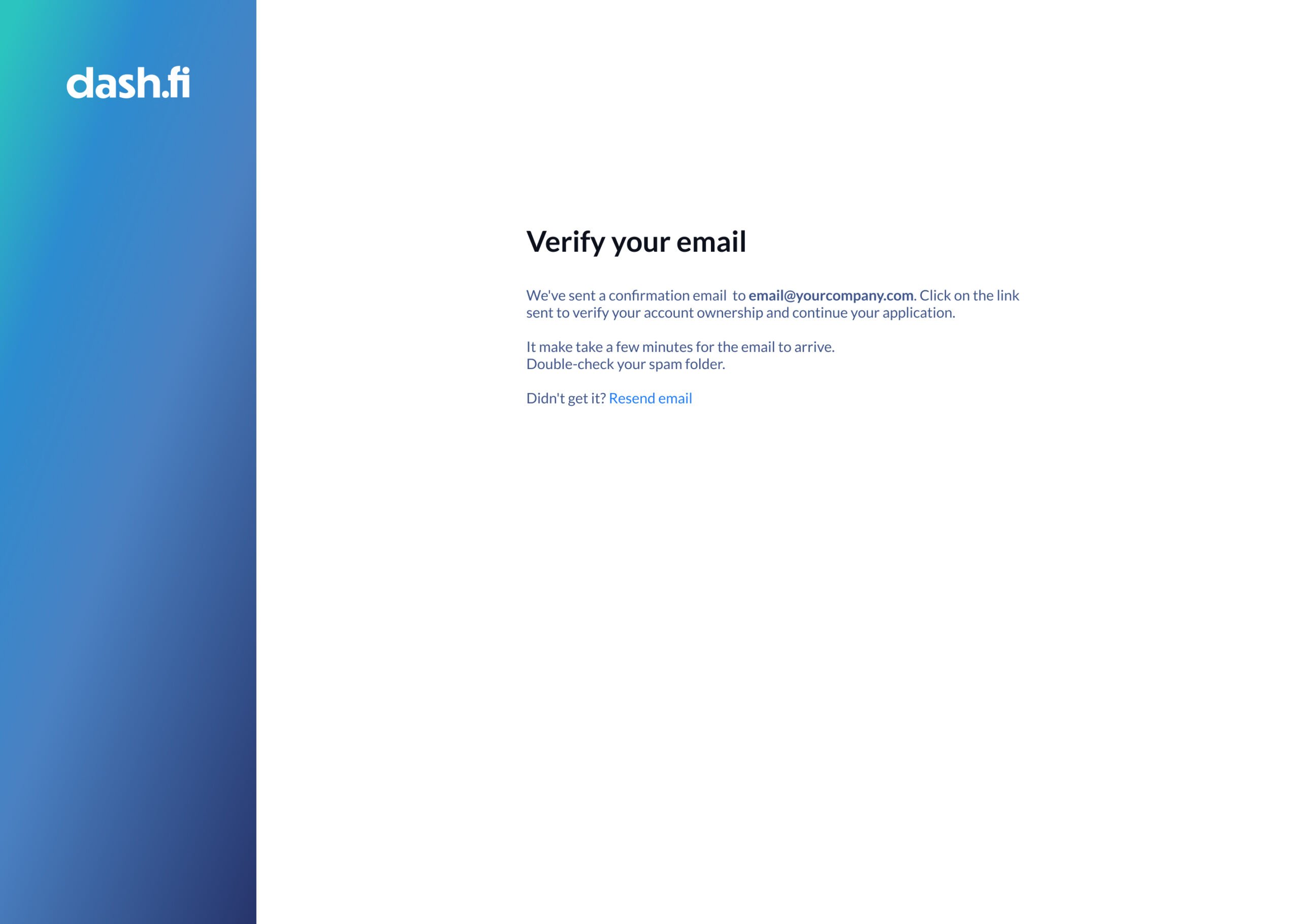

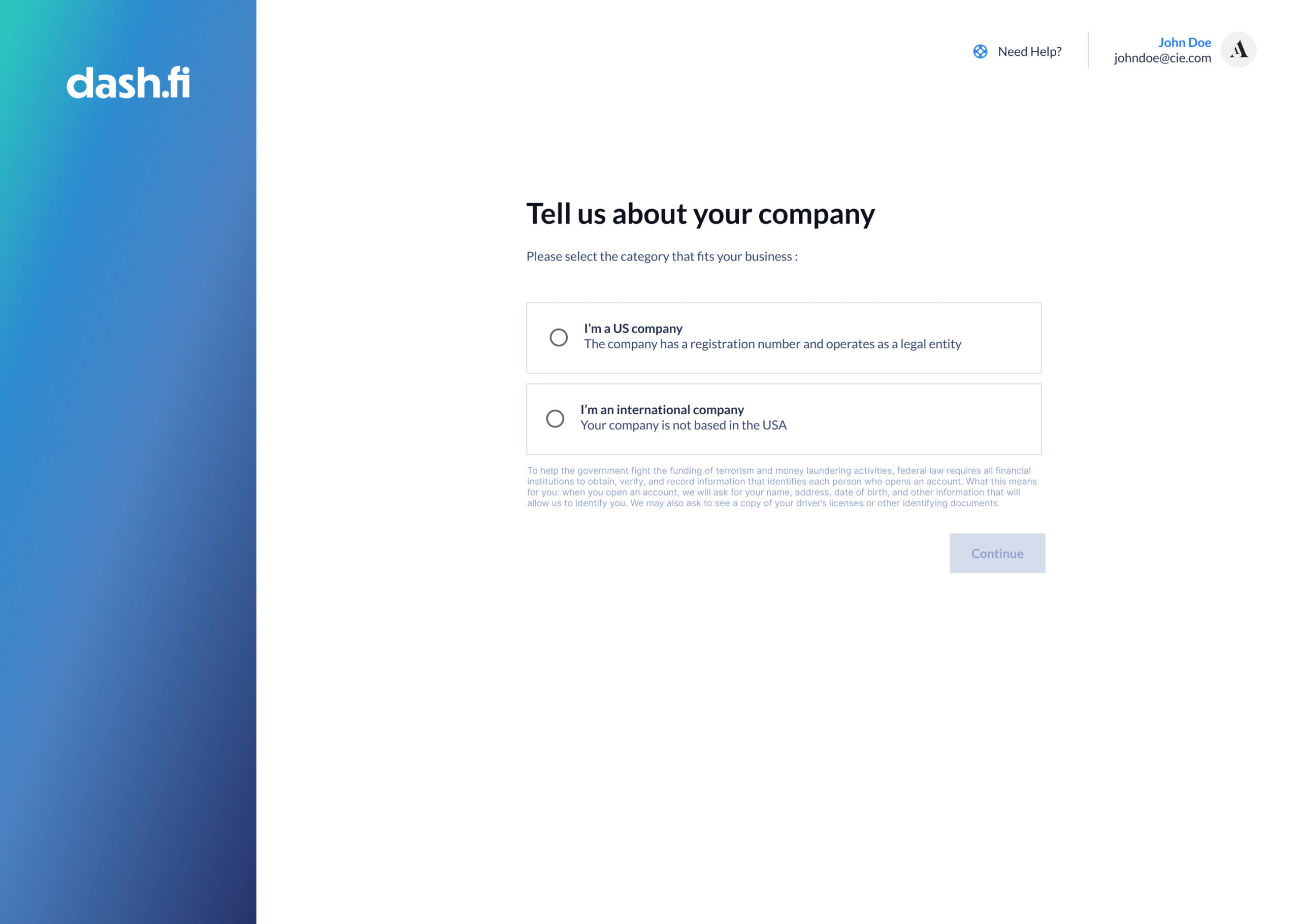

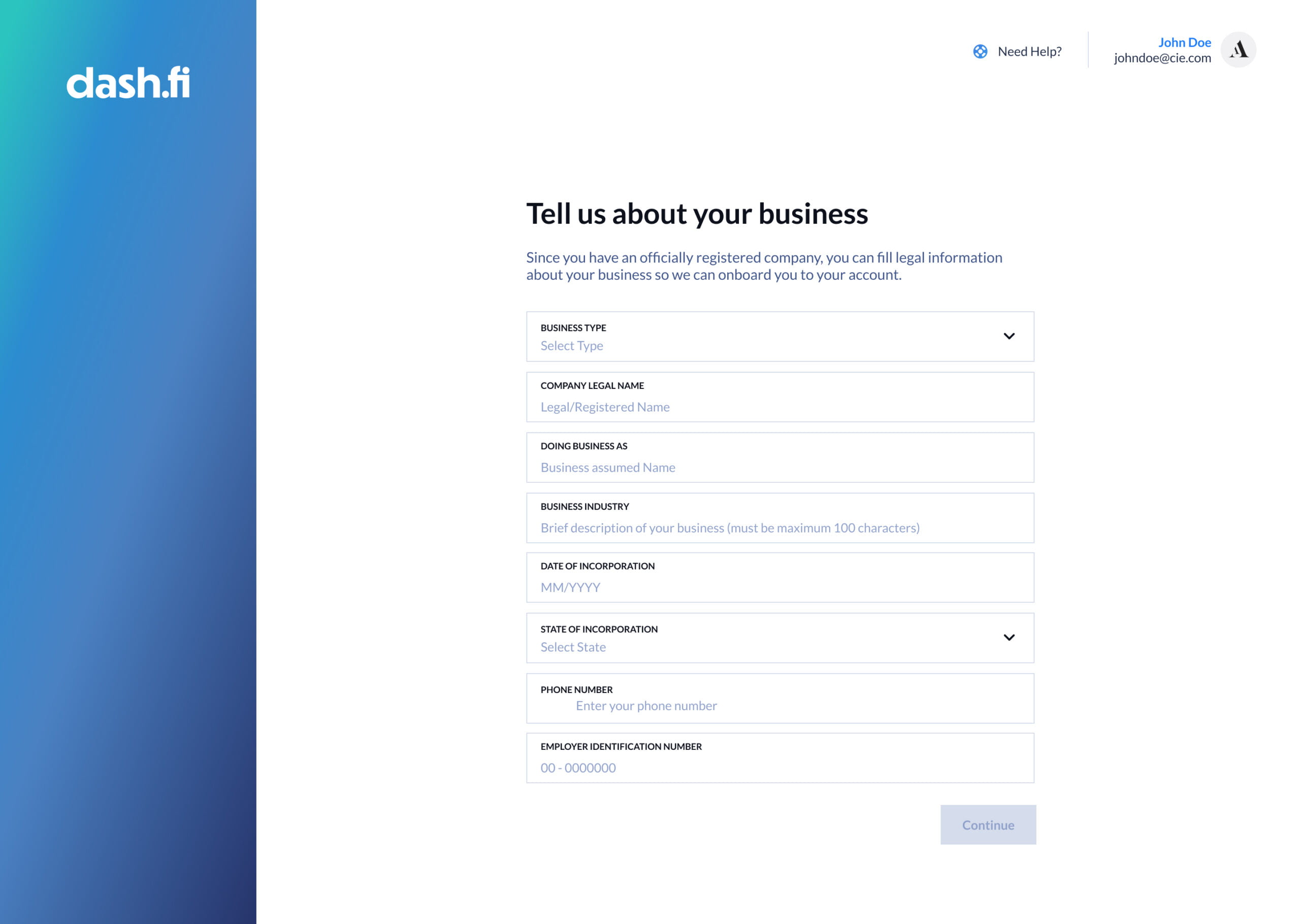

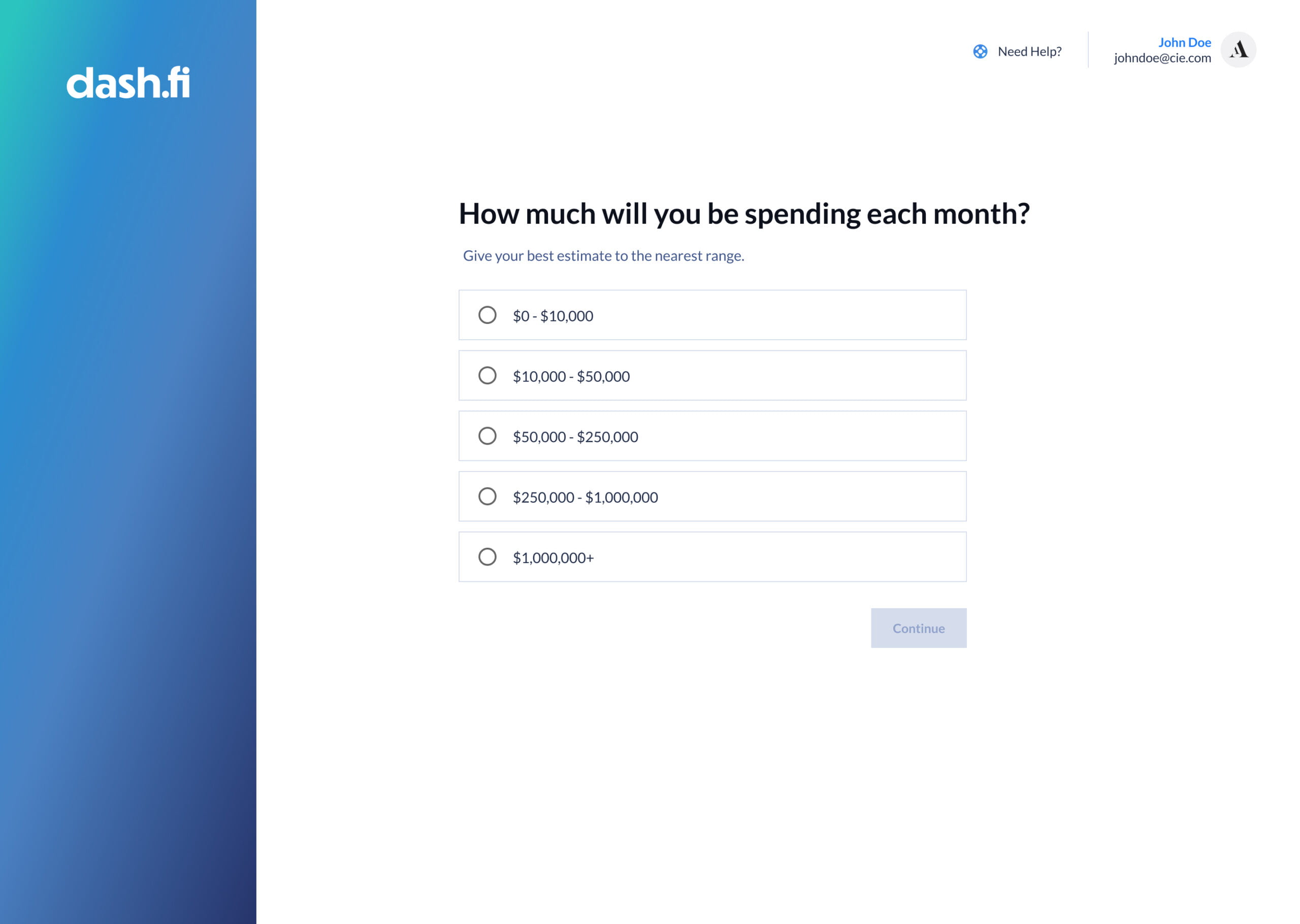

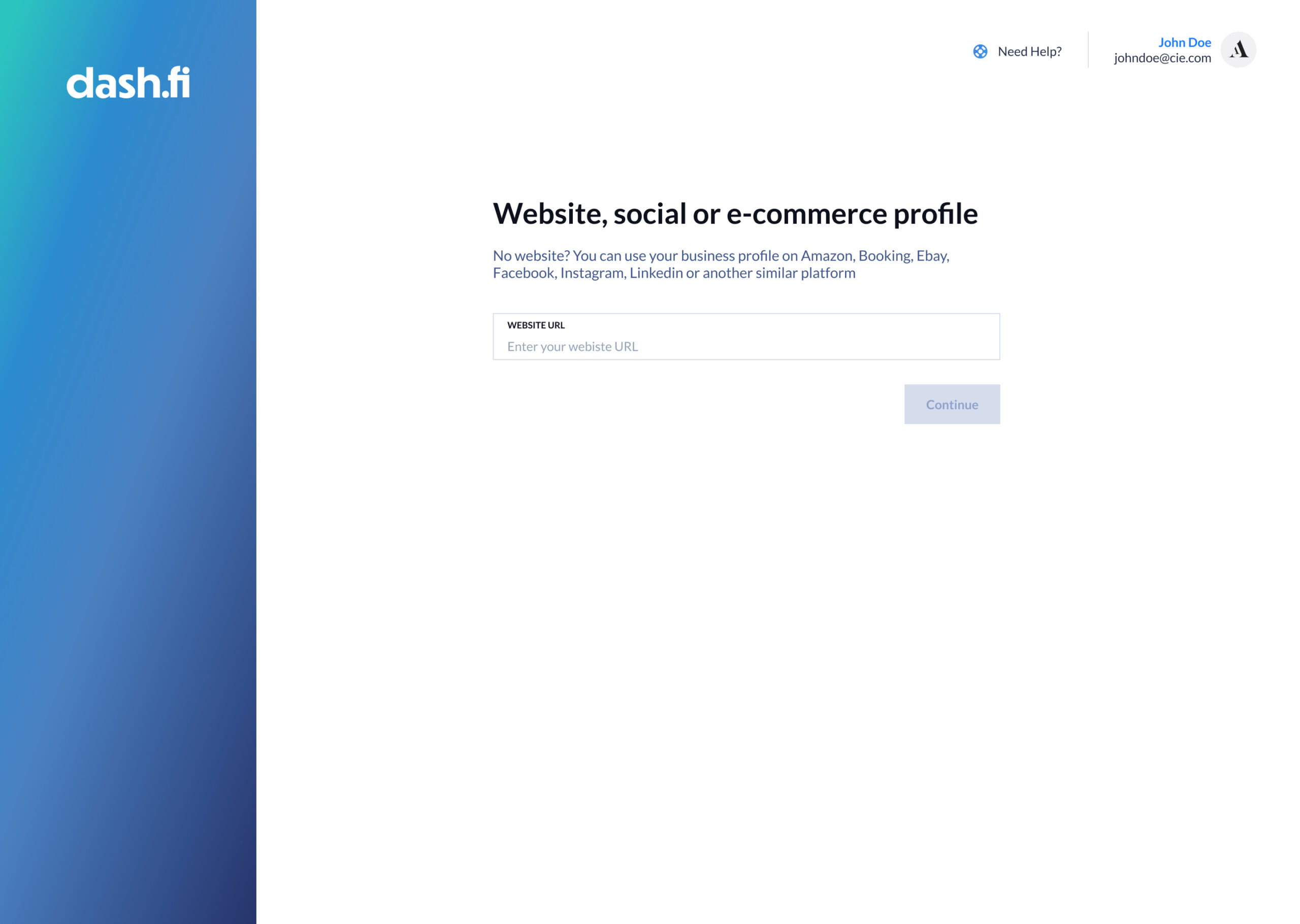

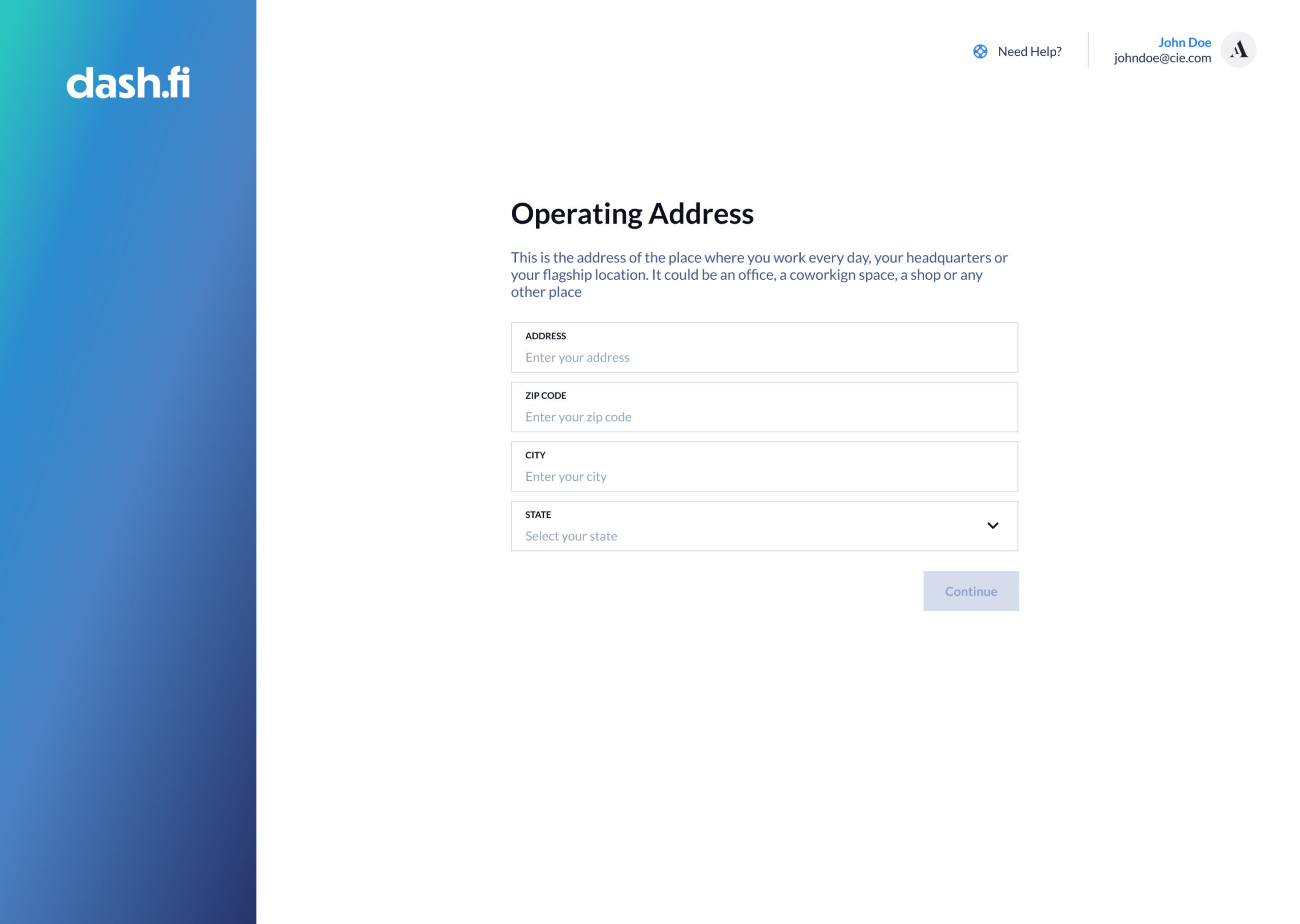

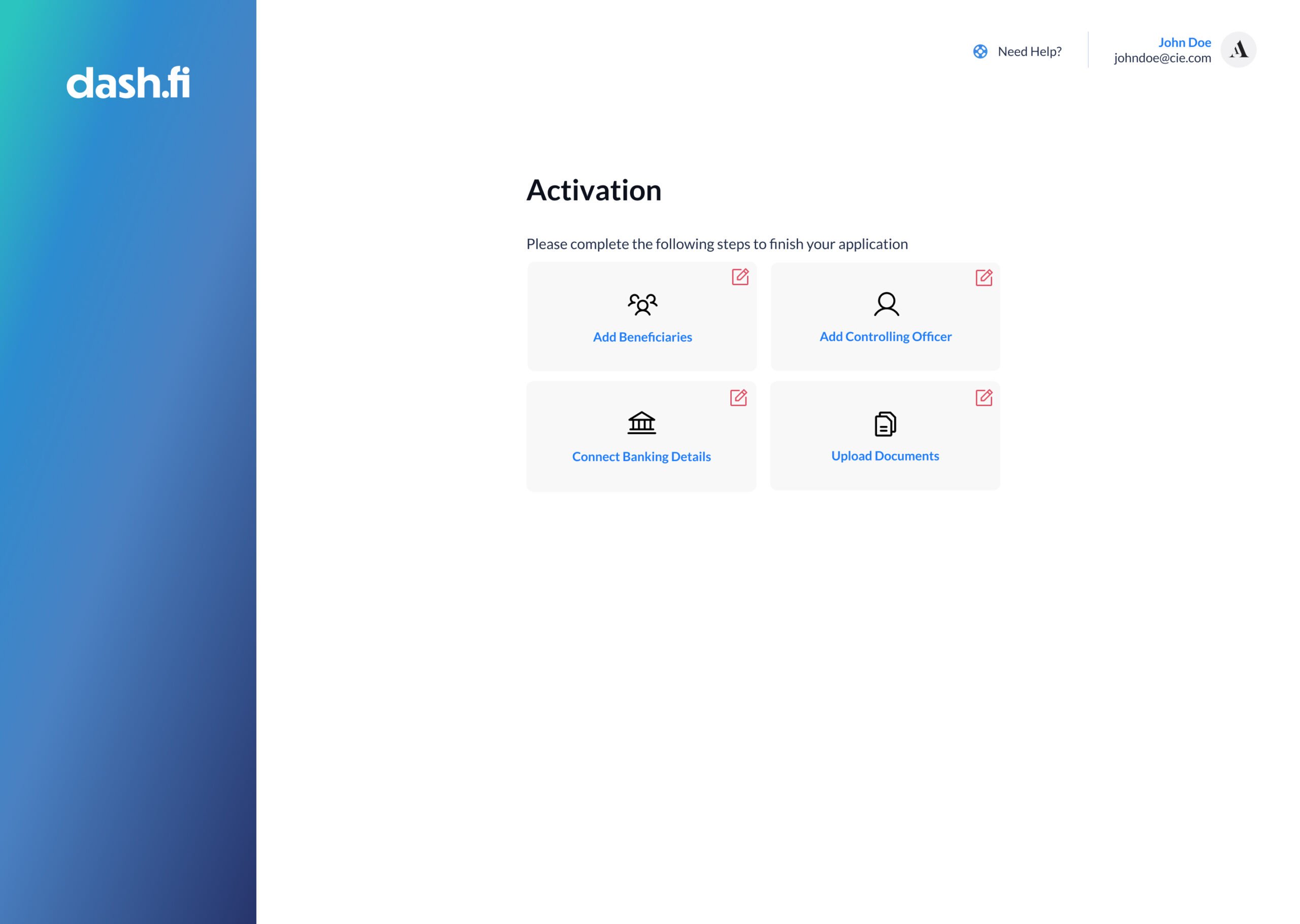

I'm faced with the challenge of minimizing onboarding friction by achieving the lowest Onboarding Friction index. This means I need to reduce the time it takes to open a new account, minimize the required fields, and ensure efficient customer verification. I'm working on creating a unified onboarding process for both domestic and international clients, as well as addressing the complexities of identifying controlling officers and beneficiaries. These objectives are central to my product development efforts aimed at enhancing the onboarding experience

I first conduct an audit of the onboarding to understand user painpoints. I created a user journey map to highlight bottlenecks and have a big picture of design opportunities. I conducted search with google analytics and hotjar recordings to understand user and traffic, understand churn rate. I ran competitor analysis, analyze user feedbacks and conduct user interviews (with users who created support ticket, who had struggle with onboarding), I ran holistic evaluation.

40% of fintech user abandon onboarding processes whenit s too long 70% decrease in average onboarding completion time Increase approved applications by 30% Selfie identification reduce fraud by 90% 80% of support issues could have been self resolved with better placeholders and error messages

Analyzing competitors like Ramp and Revolut provides insights that can shape my business strategy. Ramp's user pre-selection strategy could streamline my onboarding process, and their interactive product walkthrough might inspire me to enhance the user experience. I need to be cautious about adopting long, complex flows that could discourage potential users. On the other hand, Revolut's shorter onboarding process aligns with my goal of reducing friction. I must learn from their technical issues and lack of real-person support to offer superior service and reliability. These insights provide valuable lessons to refine my approach and gain a competitive edge in the market.

User needs to KYC and KYB verification easily User needs to submit his application quickly User needs to feel secure on the application flow If error message appears, user needs to understand what s asked User needs to be able to contact support to don't get stuck

I created user personas and journey based on the user research and testimonials, which helped me communicate my findings with the team. The persona also ensured that users’ goals and frustrations were at the front of my mind as I progressed with the flow.